By Mark Finley

Fellow in Energy and Global Oil, Center for Energy Studies

Over the past year, shale oil producers have increased production by drawing down their large inventory of drilled-but-uncompleted wells, known by industry short-hand as DUCs. I’ve written several times on this dynamic — see here, and here — and this short note provides an update.

But have most of the DUCs flown away by now?

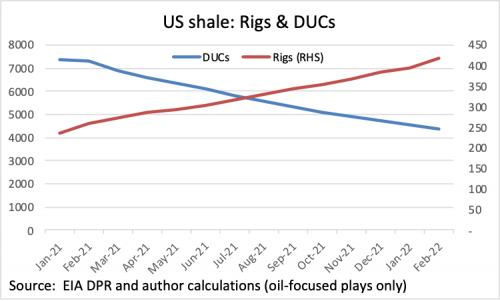

This week’s EIA Drilling Productivity Report — an excellent piece of work — shows the continued recovery rig activity in oil-focused plays (Permian, Eagle Ford, Bakken and Niobrara) as well as continued DUCs withdrawals. The pace of withdrawals has slowed — less than half the peak rate but still substantial (-132 in February).

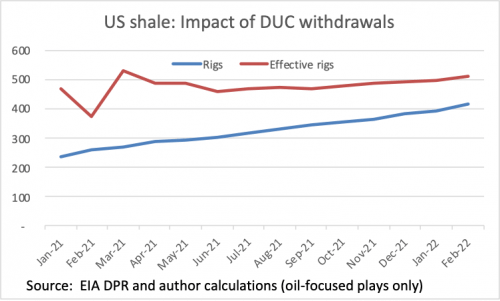

Assuming constant productivity (for both rigs and wells), we can roughly calculate the impact of DUCs withdrawals. In other words, how many more rigs would have been needed to get the same production impact without DUCs? In February, we’d have needed nearly 100 more rigs.

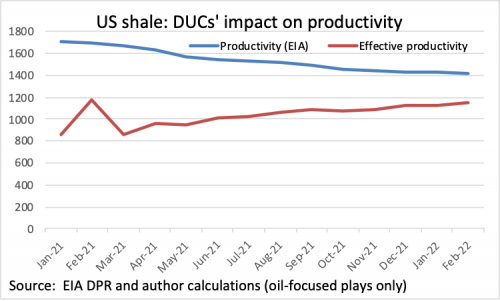

We can also see the impact of DUCs on EIA’s productivity measure, “new-well oil production per rig.” On EIA’s data productivity has been declining; correcting for DUCs withdrawals shows that effective productivity is significantly lower … but improving. Continued improvements in productivity would at least partly reduce the need for continued rig additions to offset DUCs slowing DUCs withdrawals.

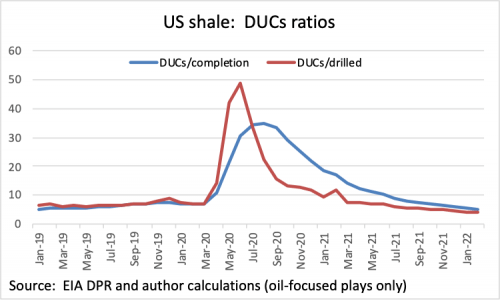

For how long can DUCs withdrawals continue to support U.S. oil production? Ratios of DUCs to underlying activity (either per completion or per well drilled) are now BELOW the pre-COVID levels. This suggests we are nearing an end of the DUCs’ contribution.

And we may already be seeing an impact for U.S. production as DUCs withdrawals slow: EIA had to revise down its expectations for U.S. shale growth in the latest DPR.

With a growing focus on U.S. domestic production in the aftermath of Russia’s invasion of Ukraine, the depletion of the DUCs inventory represents an additional challenge for domestic producers.

This post originally appeared in the Forbes blog on March 17, 2022.