By Jim Krane, Ph.D.

Wallace S. Wilson Fellow for Energy Studies

Robert Idel

Graduate Fellow, Center for Energy Studies

Peter Volkmar

Graduate Fellow, Center for Energy Studies

Mid-February has been unusually cold—for Texas. But below-freezing temperatures are a winter staple across North America and most everywhere else above the latitude of, say, Washington D.C.

Why, you might ask, do people in Ohio or France have power and heat when Texans huddled in the dark under blankets?

In a word, winterization.

Most places prepare for the cold by protecting their critical infrastructure from freezing up. Texas does not.

Outside Texas, some governments and regulatory agencies require or incentivize equipping wind turbines with heating elements to de-ice their blades and gearboxes. Other regulators require gas valves and wellheads or power plant water intakes to have de-icing protection. Some governments, mainly outside the US, mandate onsite storage of backup fuel for natural gas power plants.

But Texas regulates its own power sector. Here, cold weather precautions that keep the lights on elsewhere are recommended, not required. In this case, lax regulation exposed producers—and their customers—to catastrophic failure. The competitive nature of Texas’ deregulated power market discourages the added cost of winterization.

As the chart below shows, cold weather failures were technology agnostic. Let’s take a look by power generation type, and discuss what Texas does differently than more cautious jurisdictions.

Figure 1: Wind, gas, coal and nuclear generators all failed during the February 2021 cold snap in Texas (Source: ERCOT/Baker Institute)

Natural gas

Natural gas is the workhorse of the Texas power grid, producing half of Texas’ power on average. So, gas’ failure in Texas this week was by far the most catastrophic. There was no chance of restoring full power in Texas without restoring the gas network.

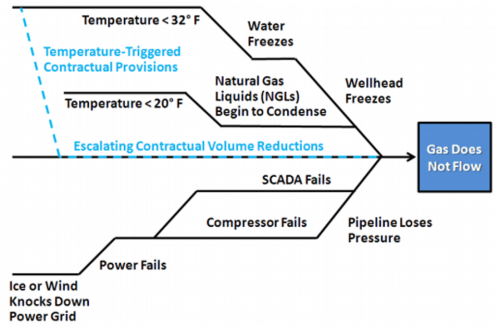

Gas fell victim to two problems: frozen pipes and power outages. These were detailed in an explainer by RBN Energy and in a 2013 study by ERCOT. Frozen pipes or “freeze offs” happen when water or natural gas liquids freeze. This can happen anywhere from the wellhead to the separator plant and along gathering, transmission and distribution lines all the way to the power plant at the far end. The diagram below provides some detail on the multiple potential failure points.

Figure 2: Numerous factors can block gas flows (Source: ERCOT 2012; http://www.ercot.com/content/committees/other/lts/keydocs/2013/BV_ERCOT_Gas_Study_Appendix_A.pdf)

The dramatic expansion of shale-directed fracking in Texas has increased the production of liquids-rich “wet” gas that contains freeze-prone gas hydrates. When hydrates freeze, they are tougher to melt than water ice. This is a well-known issue that is directly addressed in northern latitudes, but not in Texas.

Statewide power outages—partly caused by the dearth of gas—caused further interruptions. Without power, numerous points across the upstream and midstream failed, whether it was wellhead valves gauges and flow measurement equipment, or hydraulic and electric valves in the processing and transport infrastructure.

So, how might Texas producers have kept the gas flowing in cold weather? By following the precautions in cold places like the Bakken shale of North Dakota where heating elements are installed to prevent freeze-ups on critical equipment. RBN says northern producers also inject methanol into the product stream to prevent hydrates from freezing.

ERCOT says these remedies are routinely ignored in Texas.

“With gas prices being low – and storage being full – the risk of 2-3 days of possible freeze-off every several years is a risk that Gulf Coast producers have been willing to take. It is a tradeoff between lost revenue from lost production vs. lost revenue from higher annual operating costs needed to freeze-protect individual wells,” ERCOT said in 2013.

Then there is the lack of on-site fuel storage. Most gas plants in Texas—and across the United States—rely on just-in-time fuel deliveries on the US pipeline network. But in many places, including some generators in the Northeast, power plants are backed up with on-site fuel storage.

Some countries hold months’ worth of supply. Latvia, which relies on gas imports from Russia, can store a two-year supply of gas. Building onsite storage costs tens of millions of dollars even for a small plant. But Texas has depleted oil wells near population centers that might serve as cheaper regional storage.

What about wind?

Wind turbines provided an average of 23% of Texas electricity in 2020, and typically a bit more in winter due to (normally) lower electricity demand.

Texas wind generators also had their share of problems with ice, which caused up to two-thirds of the state’s wind turbines to function improperly. On cold days, the turbine and its gearbox lubricant can freeze or the output is reduced by ice-covered blades.

Technologies to remedy this are include heating elements embedded below the blades’ surfaces, and inside the turbine and its gearbox. These are used in Wisconsin, Canada, Denmark and Sweden, allowing wind turbines to produce electricity at temperatures down to -22F (-30C).

But winterization packages add about 5% to the cost of a turbine, and the power draw reduces the turbine’s output. In Texas, where wind goes toe-to-toe with rival technologies on the basis of power pricing, any added cost is a killer.

“Right now, it’s up to the private wind company to decide whether to invest in winterization,” says Vanessa Tutos, Houston-based former director of government affairs for EDP Renewables North America. “Turbine vendors offer winterization package options, but when you’re trying to offer customers the lowest price possible for clean energy, the additional cost is not insignificant.”

It’s not just Texas. Most wind turbines in the United States are not fully winterized. Cheaper de-icing solutions like blade coatings are under development.

If developers view full winterization packages as too pricey for the limited use in Texas, their only option is a difficult one: manual de-icing. This is done by spraying chemicals by either climbing up the tower or using aircraft-based sprayers. Neither of these options looked reasonable during the freeze-up.

What about nuclear and coal?

Nuclear and coal generation faced similar issues: water intake freeze-ups. Coal, which provides 13% of Texas power, saw its daily peak generation fall by 26 percent over the first three days of the cold snap, from about 11,000 Megawatt hours to 8,200 MWh.

Nuclear power provides about 11% of Texas electricity. But one of two reactors at the South Texas Project nuclear plant tripped offline on Monday. It was a big plant to lose, costing the state 1.3 gigawatts of power generation, about a quarter of its total nuclear capacity. The cold weather caused a false signal to shut down a feedwater intake, tripping a pump offline and then the entire generating unit.

In colder climates, plant operators can divert hot water discharges to the intake structure to keep it ice-free.

In summary, each of the four main Texas power generation technologies fell down on the job, leaving the electricity supply nowhere near ready to meet demand.

And what about demand?

Demand, in short, was a killer. Normally, poor weatherization in Texas homes exacerbates spikes in demand for heating during cold snaps. But ERCOT was unprepared for the size of the spike in consumption it faced heading into the polar vortex.

ERCOT’s seasonal assessment of resource adequacy (SARA[1]) report for the winter of 2020-2021 counted upon a total winter generating capacity of 67,529 MW – excluding wind and solar. The report predicted a peak demand of 57,699 MW.[2] So, even with zero wind and solar, capacity should have been adequate.

But just before the lights went out on Feb. 15, total generation exceeded both those numbers, hitting 68,022 MW at 2 am that day.

Incredibly, this demand was taking place in the middle of the night – normally the low period. By 8 pm, the period when power demand normally peaks, ERCOT was supplying only 44,809 MW to the grid.

For too many Texans, the only recourse was a warm blanket.

This post originally appeared in the Forbes blog on February 19, 2021.

References

[1] According to ERCOT, its “Seasonal Assessment of Resource Adequacy (SARA) report is a deterministic approach to considering the impact of potential variables that may affect the sufficiency of installed resources to meet the peak electrical demand on the ERCOT System during a particular season.”

[2] Ironically the SARA specifically cites the 2011 winter as a baseline for its forecast of winter demand.