By Joyce Beebe, Ph.D.

Fellow in Public Finance

The unemployment rate has been persistently low over the past few months, at around 3.6% — near the pre-pandemic level. The ratio of unemployed workers per job opening, at 1 to 2, is at its lowest level since the turn of the century — essentially meaning that, on average, there are two openings for each job-seeker. However, the robust labor market is not all rainbows and no clouds; one potentially concerning shadow is the drop in college enrollment.

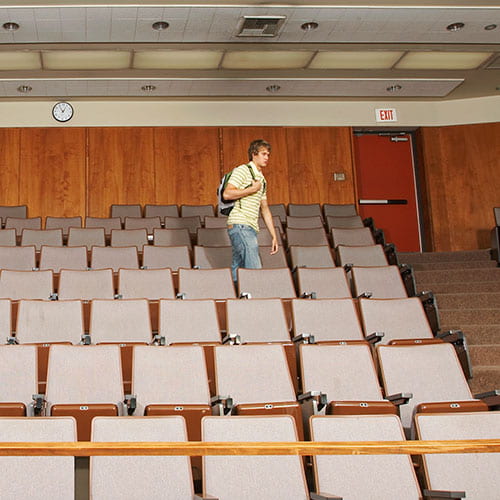

According to statistics from the National Student Clearinghouse, undergraduate enrollment has declined by 662,000, or 4.7%, between spring 2021 and spring 2022. The majority of the loss came from community colleges (351,000 students, or 53% of the total reduction) and certain public four-year colleges (240,000 students, or 36% of the total reduction). Compared to the total enrollment pre-pandemic, the student body in spring 2022 contained 1.4 million (9.4%) fewer students than it did two years ago.

College education has been viewed as an opportunity equalizer. As such, the current phenomenon is unsettling for some. On the other hand, others believe the current labor market provides once-in-a-lifetime job opportunities, and that college experiences cannot replace certain workplace trainings. This blog reviews different perspectives and summarizes results from relevant economic research to inform current discussion.

When the Rate Increases Enough and the Music Stops

Although there are debates as to what the main culprit of inflation is, there is no disagreement that a strong labor market supports higher wages, empowers more household spending and enables price increases. In response to inflation, the Federal Reserve raises interest rates, in the hopes of reducing household demand and business investment. The most desirable outcome to the current surge in inflation is the Federal Reserve’s successfully accomplishing a soft landing, modestly slowing down the economy without causing high levels of unemployment. The entire cycle has not concluded, and the Federal Reserve has indicated it may increase rates again in July and throughout the year until inflation is under control.

The Federal Reserve is determined to tame soaring inflation, but a rate increase usually comes with at least a six-month lag, and it could even be as long as nine to 18 months before its effects are fully seen. Until that happens and the tide turns, the current job market is especially appealing for young workers who are getting their first paid jobs, or who have been working at entry-level positions. It has been so extraordinary that many of them are deciding to postpone college and jump on the high-wage wagon.

It is not surprising that some prospective students stay out of school when the economy is good and the job market is strong, because the opportunity costs are high for them — meaning that they would be giving up good wages to attend school. However, the real question is how these young workers will fare once the Fed successfully achieves its goal (and it will) — at best, executing a soft landing, and at worst, causing a recession.

Many people are familiar with the statistics demonstrating that college graduates earn more than high school graduates. In 2021, a worker with high school diploma had median weekly earnings of $809, whereas a worker with an associate’s degree earned $963 per week and a college graduate earned $1,334 per week. This means that the associate degree-holder earned 20% more than the high school graduate, and the bachelor’s degree-holder earned 65% more. Higher education attainment is also more likely to protect a worker from becoming unemployed: high school graduates had an unemployment rate of 6.2% in 2021, whereas 3.5% of bachelor’s degree-holders were unemployed.

Some youth argue that the current job market offers them unprecedented opportunities — both from experiential and financial perspectives — and they are in the “right place, at the right time” to take advantage. For instance, the Bureau of Labor Statistics (BLS) stated that between 2020 and 2030, about 60% of new jobs created in the economy will be in occupations that require no college degree, primarily in the transportation, maintenance and construction industries — although many will still have lower median annual wages than openings that require college degrees.

However, many believe the value of a college education not only supports current earnings, but also the skills that make workers more versatile so they can be more resilient to the next downturn. In addition, many current positions that are available for lower-skilled workers are susceptible to being replaced or curtailed by artificial intelligence and automation.

A Tale of Two Enrollment Patterns

What is more alarming is the divergent enrollment patterns across different types of higher education institutions. Based on the aforementioned statistics, selective flagship public universities and private not-for-profit colleges have continued to attract record number of applicants, despite the pandemic and the hot job market. Conversely, a large portion of the enrollment drop came from community colleges and regional public universities, which typically serve low- to moderate-income students.

From a long-term earnings perspective, economic literature generally shows a positive return for college education. The returns are especially prominent for students who attend four-year public and non-profit private colleges as well as community colleges. In addition, higher education provides benefits not only to students but also to society, which go beyond greater earnings and the resulting higher tax revenue paid to the governments.

Many have argued that the “on-the-fence” students, who are at the crossroads of deciding whether to attend college and have not entirely made up their minds, are the ones who would benefit the most from enrolling. Several studies have documented that encouraging uncertain college attendees — who are disproportionally at risk for social problems such as health, teen pregnancy and crime — to attend college is likely to generate a range of social benefits that go beyond increased earnings and employment.

In light of these financial and social benefits, the real issue is whether the reduced enrollment is temporary, in which case the students will return to campuses once the job market cools down, or the 1 million students are lost for good. Unfortunately, if evidence from the prior housing market economic cycle provides any reference, the non-enrollment decision appears to be permanent.

At least one study shows that the housing market boom and bust between the late 1990s and late 2000s coincided with declining growth in college enrollment, with 25% of this reduced enrollment explained by the prosperous housing market. Some young adults delayed attending college because they were attracted by the job prospects in the booming housing sector. These jobs are mostly opportunities in the construction, finance, insurance and real estate sectors that support the housing market, as well as positions where workers provide local personal services (e.g., gardeners, cleaners, hairdressers and waitresses). These are relatively low-paying jobs with poor long-term prospects.

Among candidates who delayed attending college when young (e.g., age 18-20), many did not eventually attend. As a result, the study concludes that the strong housing market had a negative effect on undergraduate college attendance, which can lead to persistent negative labor market outcomes for students who decide not to enroll. In other words, the non-enrollees’ earning trajectories were altered as a result of their decision to not attend when the job market was robust.

Additional Considerations

Whether and when the current college enrollment level will rebound primarily depends on the conditions of the labor market, which hinges on the economy’s response to Federal Reserve’s rate hikes. However, several undercurrents may indicate more comprehensive, structural changes.

For instance, the pandemic fundamentally changed the delivery of higher education. Remote learning became the norm at the peak of the pandemic and continues to be an option at many institutions. As the pandemic recedes, many instructors continue to embed relevant remote-learning features in lectures, including prerecorded videos, remote office hours and other asynchronous deliveries. Students who do not respond well to remote learning may decide to postpone attendance, leading to lower enrollment. To the extent that this is the case, and the students are still determined to return, the drop in enrollment will be short-lived as campuses return to in-person lectures.

In addition, it is uncertain how the demographic trends will shape short- to mid-term labor market prospects. Although there is no doubt the vast majority of baby boomers will leave the workplace within the next decade, whether the pandemic is accelerating or postponing their retirement is still uncertain. Some believe the pandemic has motivated a large number of baby boomers to leave the labor force due to public health considerations; however, others believe a fair portion will “un-retire,” or work longer to secure a better retirement. In addition, the labor market could also be regional, with some industries affected more than others to the extent telecommuting is not a viable option. Some states will experience more population inflow whereas others will lose residents, affecting the pool of available workers.

This is certainly not to say everyone needs to go to college. Many other career options, including trade schools and vocational training programs, are equally rewarding and valuable. However, if a student is college-bound but decides to not attend because of high wages in the current job market, the student should make sure this decision is truly temporary. Used properly, a “gap year” can help young workers gain work experience and perspective before returning to campus. In addition, going to school and working part-time, or leveraging employer tuition assistance programs, are good alternatives.