By Alisha Small

Scholar for Economic Growth, McNair Center

As 2021 comes to an end, many firms that provide employee benefits on a calendar-year basis have ended open enrollment for the 2022 benefit year. Employees have weighed their medical coverage and cost options and have made final decisions to opt-in to new health plans, stay with existing health plans, or opt-out of employer-sponsored health plans. Firms will soon implement employee health care benefit elections for 2022.

In April 2019, before the COVID-19 pandemic began, 37% of small business owners considered the cost of providing health care coverage to employees to be the biggest challenge for their businesses.[1] Perhaps surprisingly, the latest national data published by the U.S. Department of Labor suggest that the COVID-19 pandemic has not given small businesses greater cause for concern over the cost of health care benefits. The employer cost of health care benefits for small firms (1 to 49 workers) has not risen significantly over the last two years, and the percentage of small firms offering health care coverage has actually increased.

- From March 2019 to March 2021, the percentage of small firms offering health care benefits increased from 52% to 58%.[2]

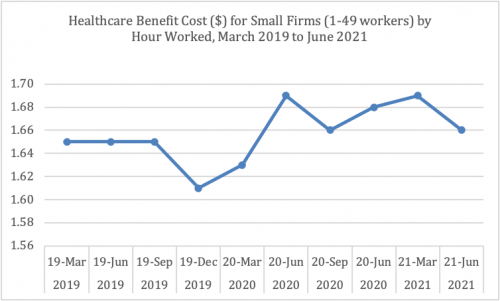

- From June 2019 to June 2021, the cost for health care benefits per hour worked for small firms increased from $1.65 in June 2019 to $1.69 in June 2020 and then declined to $1.66 in June 2021.[3] The pre-pandemic to post-pandemic cost per hour increased by only 0.6%.

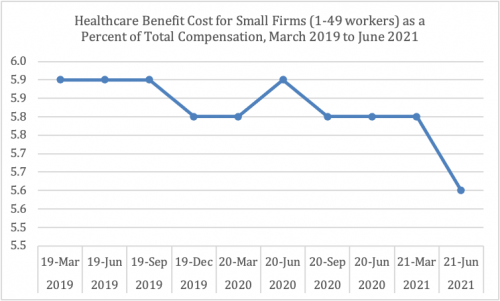

- From June 2019 to June 2021, the cost of health care benefits as a percentage of total compensation decreased from 5.9% to 5.6%.[4]

The Labor Department’s latest Employment Situation reports that monthly job growth has averaged 555,000 so far this year.[5] As the data show, those jobs have not come with fewer health care benefits or higher health care benefit costs to employers in spite of the pandemic.

Health Care Benefit Cost for Small Firms (1-49 workers) by Hour Worked, March 2019 to June 2021

Source: U.S. Bureau of Labor Statistics

Health Care Benefit Cost for Small Firms (1-49 workers) as a Percent of Total Compensation, March 2019 to June 2021

Source: U.S. Bureau of Labor Statistics

[1] Rhett Buttle, Katie Vlietstra Wonnenberg, and Angela Simaan, “Small-Business Owners’ Views on Health Coverage and Costs,” The Commonwealth Fund, Sept. 9, 2019, https://doi.org/10.26099/v0x3-ww23.

[2] National Compensation Survey: Employee Benefits in the United States, March 2019, U.S. Bureau of Labor Statistics (September 2019): 179, https://www.bls.gov/ncs/ebs/benefits/2019/employee-benefits-in-the-united-states-march-2019.pdf; National Compensation Survey: Employee Benefits in the United States, March 2021, U.S. Bureau of Labor Statistics (September 2021): 187, https://www.bls.gov/ncs/ebs/benefits/2021/employee-benefits-in-the-united-states-march-2021.pdf.

[3] National Compensation Survey: Employer Costs for Employee Compensation Historical Listing, U.S. Bureau of Labor Statistics (June 2021): 511, https://www.bls.gov/web/ecec/ececqrtn.pdf.

[4] National Compensation Survey: Employer Costs, 511.

[5] “The Employment Situation, November 2021,” U.S Bureau of Labor Statistics, press release, December 3, 2021, https://www.bls.gov/news.release/pdf/empsit.pdf.