By Mark Finley

Fellow in Energy and Global Oil, Center for Energy Studies

There’s finally some good news in the U.S. oil patch after a rough couple of years. The U.S. has added nearly 300 oil-focused rigs (though the count is still about one-third below pre-COVID levels). Banks are starting to open their wallets for drillers. Optimism is returning: The U.S. Energy Information Administration (EIA) projects that, after two consecutive annual declines, domestic production of crude oil and natural gas liquids will grow by 1.3 million barrels per day (Mb/d) in 2022.

The recovery in investment and drilling is evident in growing domestic production: Crude oil output in oil-focused shale plays hit a low-point of just over 6 million barrels per day (Mb/d) earlier this year (with twin impacts from the COVID-driven price and investment collapse, as well as the deep freeze of winter storm Uri). Output now stands at about 7.7 Mb/d — though again, it remains well below the pre-COVID peak of 8.5 Mb/d in March 2020.

I’ve written several times about the prospects for U.S. shale production and the broader implications for the oil market (for example, see here and here). For an analyst like me, U.S. shale production is a perfect topic to write about: it’s big; always-changing; with big impacts on the economy (as well as the strategies of OPEC and other market players) … and there is lots of good data available!

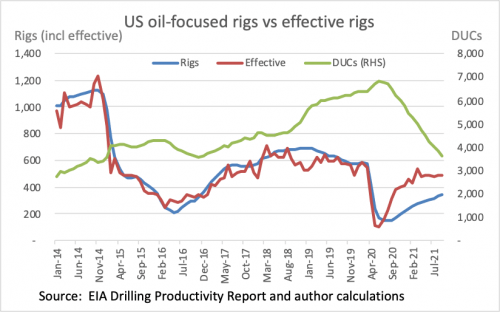

I’ve previously explained a key tactic used by the industry to weather the COVID-driven downturn: sharply cutting drilling, yet sustaining production by dramatically reducing the inventory of drilled-but-uncompleted wells (or DUCs). Based on the latest data from EIA, the withdrawal of DUCs in oil-focused plays continues, allowing the industry to continue bringing new wells into production without bearing the cost of drilling those wells.

The reduction in DUCs last month was equivalent to boosting the oil-focused rig count by over 40% — that is, it’s as if nearly 500 rigs were working rather than the roughly 350 that EIA actually counted in its latest monthly Drilling Productivity Report (DPR).[1] Based on that estimate, I calculate that the DUCs inventory has contributed over 1 Mb/d of new production since the onset of the COVID pandemic. That is, if U.S. oil production in these plays had been driven only by new wells drilled & completed — with no change in the DUCs inventory — U.S. production today would be more than 1 Mb/d lower.

As I explained previously, the industry will need to significantly boost new drilling to replace the production impact currently provided by drawing down DUCs as the inventory of DUCs is depleted. Even with the domestic rig count rising robustly, this represents a potential headwind for U.S. production in the months ahead.

And there’s another potential headwind for the U.S. shale industry as it tries to rebound: productivity. Dramatic improvements in productivity — driven by innovations in drilling and completion — helped the industry weather previous price declines, and EIA recently pointed out that drilling and completion efficiency continues to improve. But improvements have slowed significantly in recent years as the technology has matured. Indeed, pre-COVID, EIA’s productivity measure for shale operations (new production per working rig) had plateaued.

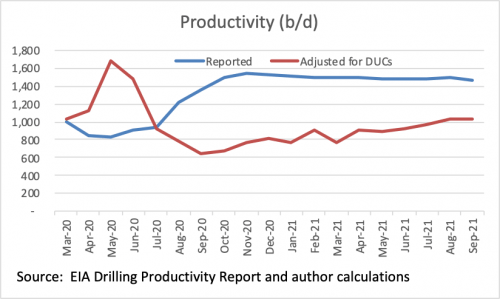

Then a funny thing happened: After COVID hit, the EIA’s data on productivity of shale operations skyrocketed. A weighted average of the reported data for oil-focused plays shows that new production per working rig rose from roughly 1,000 b/d at the onset of the pandemic to 1,500 b/d by last summer … and has remained near that figure ever since. Pre-COVID, it had taken five years for productivity to grow by that much.

On one level, perhaps that isn’t surprising. After all, when the industry contracted following the COVID-driven price collapse, only the best crews were left, working the best geological prospects, with the best rigs and completion kits. And nothing forces innovation like the need for survival (see “negative U.S. oil prices”)! While companies argue that the dramatic improvements seen post-COVID will be durable, one would expect to see some degradation of this productivity measure in recent months as prices increased significantly and industry investment and activity rebounded. Indeed, EIA’s reported productivity data has dipped after peaking in November of last year — albeit only by 5%.

Nevertheless, that’s not the whole story. There also appears to be a data reporting issue: As noted above, withdrawal of DUCs has contributed a large share of new U.S. crude oil production — but this is not reflected in the rig count.

That greatly complicates our ability to interpret EIA’s productivity data.

But there’s another way to develop a stylized view of shale productivity. Using EIA’s reported data for rigs, DUCs and production,[2] I use a two-step process to reverse-engineer a stylized estimate of productivity.

First, I correct for the DUCs issue by substituting the effective rig count — adding the number of rigs equivalent to the reduction in monthly DUCs as described above. This gives a figure that more closely represents the productivity of new wells. As expected, it runs above EIA-reported figures when DUCs were increasing early in the pandemic, but then runs consistently below EIA figures as DUCs have been withdrawn. On this basis, per-well productivity today is broadly what it was pre-COVID.

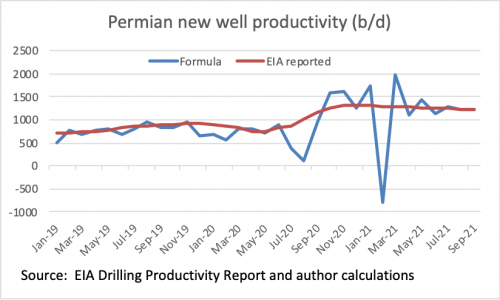

And there’s another problem we still need to address: In the documentation for the DPR, EIA reports that “average new well production rate per rig is calculated as the product of the number of wells drilled per rig and the average production per well. This calculation is subject to the Rig Count to Well Count Delay, such that the production per rig for the current month is applicable to the rig count two months prior.” That formula works for the last month or two, and is generally close to the reported data for most months — but the data during COVID goes completely crazy, as EIA struggles to grapple with wells that were shut-in (due to the negative price episode last year or the deep freeze this year), many of which subsequently returned to production. The EIA formula runs below the reported data in periods with large production shut-ins, and runs above the reported data for periods when shut-in production returns. EIA smooths this data for continuity — see the example below for the Permian basin.

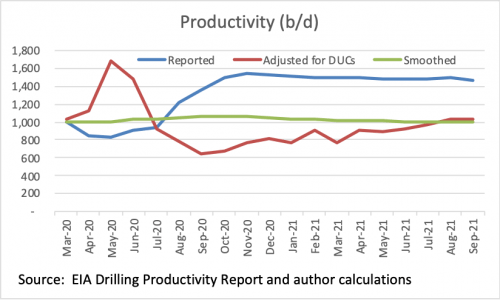

And here’s the final piece of the puzzle. As EIA does, I use judgment to smooth the DUCs-adjusted productivity to account for actively-producing wells that are shut-in, and subsequently returned to production. I roughly anchor the starting and ending points on the adjusted data as described above, on the assumption that shut-in and returning wells were not a material consideration pre-COVID, nor today. (Important caveat: Again, this is a very stylized approach using aggregate data … researchers with access — for a price — to well-by-well data can answer these questions with much greater authority and accuracy.)

But what this highly-stylized data shows is a profile for productivity that appears more in line with what one would expect:

- Rising as the industry contracted sharply early in the pandemic, although not as aggressively as the EIA productivity figures show; and

- Falling as the industry expands — though the decline is slow because industry learning and continued innovation help to offset the productivity losses associated by moving to less competitive crews, rigs and geography.

What does this mean going forward?

I see both good news and bad news. The bad news is that, if productivity continues to edge lower as activity recovers, it would represent a further headwind for future U.S. oil production. The good news is two-fold:

- The adverse impact would likely be small compared with the DUCs challenge. The industry needs to add 40% more rigs to offset the coming exhaustion of the DUCs inventory while maintaining current production. A further 5% decline in productivity would require an additional 5% increase in rigs to keep output stable. Note that both of these increases in the rig count would be needed just to hold production steady; even more rigs would be needed to grow production. (Unfortunately, the EIA does not forecast rigs or DUCs in its oil market outlook.)

- Finally, if history is any guide, we can expect the ingenuity and competitiveness of U.S. companies to continue driving innovation. That is, after all, how we got the shale revolution in the first place!

Bottom line: Official data suggests U.S. shale producers have realized sharp productivity gains since the COVID-driven price collapse, as has been the case in earlier downturns. But correcting for a gap in the Energy Department’s data reporting yields a more cautious view on productivity gains. The short-term question is, will productivity become a tailwind or a headwind for domestic producers as they seek to capitalize on higher prices?

The U.N. COP26 meeting in Glasgow begins this week, bringing expectations for new policies to reduce longer-term demand for oil and other fossil. If the oil market does indeed contract because of new policies, productivity gains will be a crucial factor for U.S. shale production to remain competitive.

___

[1] This analysis assumes for simplification that DUCs being brought into production have the same average crude oil output as the national average of all shale wells.

[2] And adding the assumption that decline rates are relatively stable. EIA’s data shows a weighted average decline rate in oil-focused plays of 5.5% in the most recent month, very close to the decline rate reported pre-COVID (in February-March 2020).

This post originally appeared in the Forbes blog on October 25, 2021.