By Steven R. Miles, J.D.

Nonresident Fellow, Center for Energy Studies

Kenneth B. Medlock III, Ph.D.

James A. Baker, III, and Susan G. Baker Fellow in Energy and Resource Economics

Senior Director, Center for Energy Studies.

One of the most highly-touted provisions of the US-China Phase 1 Trade Agreement requires China to purchase $50 billion of US energy products in the next two years. From the beginning there were doubts as to whether China could purchase that much energy from the US in such a short period. Since then, the impact of the novel coronavirus on the Chinese economy, and consequently Chinese energy demand, has compounded those concerns, raising serious questions about whether the energy component of the trade agreement is already doomed to failure.

Even if China could purchase and take $50 billion of US-sourced energy products in CY 2020 and 2021 as required by the agreement, doing so would bring little if any benefit to either the US or China, as such short-term purchases would be from projects already constructed and which have already sold their offtake for years to come. As a result, the thousands of jobs needed to building new energy facilities would not materialize, depriving the US of one of the key benefits of the Trade Agreement. However, there is a solution: a mutual understanding between the two sides that commitments to long-term purchases from new or expanded facilities “count” toward fulfilling China’s obligations under Chapter 6. Under such conditions not only both countries could benefit but also would establish a foundation upon which to build future trade agreements.

Where are the benefits to the US and China?

The Phase 1 Trade Agreement requires China to complete its energy purchases in less than two years. However, the development and construction of large-scale energy export facilities takes years. As an example, construction of a large liquefied natural gas (LNG) facility typically takes up to four years and requires billions of dollars of capital. Financing of these projects usually depends on the project sponsor signing customers to long-term offtake contracts that require the customer to take, or at least pay for, the energy products, thereby making the contracts “bankable.” However, the six currently operating LNG export terminals in the United States have collectively already sold over 95% of their publicly stated production capacity, almost all pursuant to long-term contracts. Thus, the requisite $50 billion of energy commodity purchases from the US under the Phase 1 Trade Agreement would, with regard to LNG, be met by China through repurchases of cargoes (or capacity allotments) that have already been sold by US producers. Cargoes would be swapped and resold, and flows would be readjusted, likely yielding little if any increase in net energy exports from the US.

Worse yet, most of the revenue gains from Chinese imports of US LNG would likely not accrue to US exporters. Incremental revenues from swaps and resales would likely flow to the entities that have already contracted to purchase and lift cargoes, and not to the US LNG producer. Almost all LNG currently exported from the US is either sold and delivered to the buyer in the US port or delivered by the operator in the US port pursuant to a terminal services agreement. Either way, the US LNG producer typically ceases to have any involvement with (or profit from) the LNG once the vessel is loaded at the US port. Hence, the reselling of cargoes already committed to be taken would likely yield little if any benefit to the US. Even if increased spot purchases resulted in the taking of cargoes that might otherwise be canceled (whether due to low prices, reduced demand, or something else), the vast bulk of infrastructure that would be used to produce, transport, liquefy, and store natural gas is already in place for the next two years. Thus, the Phase 1 Trade Agreement, even if fully complied with by China, could result in little or no net investment or job creation for the energy industry in the US.

Just as the benefits to US exporters are doubtful, the benefits to Chinese importers from spot cargo purchases are likewise uncertain. China, like other large energy-consuming nations, benefits from having multiple secure sources of energy at competitive prices. New facilities, underpinned by long-term purchase commitments, could provide an additional competitive source of supply for China and other customers for up to 30-40 years, some 15-20 times the duration of the Phase 1 purchase. However, buying spot LNG on the secondary market would largely result only in swaps and the rearrangement (but not increase) of cargoes from existing supply sources to Asia.

Enter: Coronavirus

Recent events raise another concern with any requirement that China purchase $50 billion of energy products in the next two years. Compressing purchases into a short time horizon leaves the Phase 1 Trade Agreement hostage to short-term disruptive events that impact Chinese demand. As we write, the coronavirus has restricted the movement of people and the flow of goods, thereby negatively impacting economic growth in China and around the world. The resulting decrease in energy demand will make a $50 billion purchase in the short-term even more challenging. Some have suggested that China could be backed into a corner where it needs to declare force majeure – an excuse for not satisfying a contractual obligation because of certain unforeseen events that are beyond the party’s control – from its obligation to purchase $50 billion of energy products over the next two years.

A “win-win” for the US, China and the Trade Agreement?

Fortunately, the Phase 1 Trade Agreement could still be a success in the energy domain, paving the way for additional future agreements between the parties. This would require only a fairly minor change in interpretation, namely, counting long-term purchases toward the import commitments. The results could be transformational: the agreement would produce substantive benefits for both the US and China, and reduce the risk of default or declaration of force majeure by China based on short run considerations.

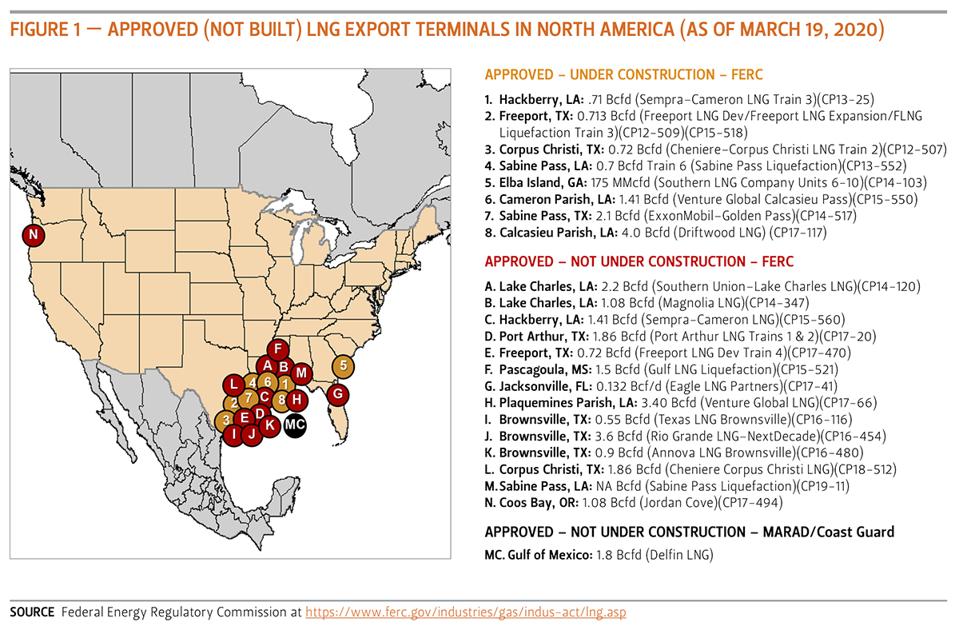

In the US, the LNG pump is primed and there is no shortage of opportunities for Chinese purchase commitments to push projects forward rapidly. As shown in Figure 1, there are over a dozen pending LNG export projects in the US, some of which could achieve financing and proceed to a final investment decision this year if a buyer, such as a major Chinese state-owned oil and gas company, would enter into a binding long-term (typically 20 or more years) LNG sales agreement for a sizable volume of LNG. The launch of such a new (or expanded) project would result in tens of billions of dollars of new investment in US energy infrastructure and the creation of thousands of new jobs, potentially starting in 2020.

LNG

FERC

From China’s perspective, purchasing spot cargoes gives it no certainty about the availability of reliable long-term supply. But if China were to contractually underpin the launch of a new LNG liquefaction facility, it would have an additional committed supply source for decades. A long-term commitment to purchase energy from a new US facility would also allow China to get past any near-term economic impacts of the coronavirus.

As an example, if China were to enter into a long-term LNG purchase agreement for the output from two “trains” with a typical size of 4 million tonnes of LNG per annum, the revenue paid by the Chinese purchaser to the US exporter could reach $1.5 billion to $2.5 billion annually, or $30 billion to $50 billion over the life of a contract, based on recent forward prices. If the two countries agreed to such an interpretation of the Phase 1 Trade Agreement, two such purchases could satisfy the entirety of the $50 billion purchase requirement. Such an agreed interpretation would assist both countries in their fight against the economic distress caused by the coronoavirus. China would be relieved from buying energy it may not currently need, and the US would receive the benefits of increased job creation and investment in the energy industry that come with building new export facilities.

The post originally appeared in the Forbes blog on April 8, 2020.