By Rachel A. Meidl, LP.D., CHMM

Fellow in Energy and Environment, Center for Energy Studies

Mathilde Saada

Research Assistant, Center for Energy Studies; Master of Global Affairs student

With the pressures of climate change and the urgency to incorporate alternative energy resources like wind and solar, the fixation on the purported benefits of energy transition technologies overshadows the glaring reality — an absence of strategy around identifying and quantifying other life cycle externalities, such as waste disposal or environmental impacts.

The energy industry, governments and society have yet to fully understand the incoming waste quantities and the long-term impacts associated with end-of-life solar PVs. If a sustainable and circular future is the preferred way forward, controlled management of end-of-life panels in permitted recycling, treatment and disposal facilities is necessary.

What’s at Stake: Solar Waste

Cumulative solar waste projections worldwide are anticipated to reach around 78 million tonnes by 2050. However, many of these forecasts assume full lifespan of 25-30 years of panels and do not account for early replacement, rapid obsolescence and widespread premature decommissioning driven by solar tax credits, compensation rates, installation price, severe weather events and China’s role that could ultimately push those numbers even higher. Aside from attractive tax subsidies that have resulted in massive and unprecedented solar growth, the conversion efficiency of panels has improved year after year, thanks to manufacturing innovations in China, which dominates and controls the solar market. In the U.S., solar has been showcased as a critical solution to combat climate change, an attractive investment for companies and investors that aligns with their environmental, social and governance goals, and a job creator.

But the looming waste volumes run counter to a circular economy and pose a threat to global and national sustainability goals.

Dissecting a solar photovoltaic (PV) panel and understanding its anatomy reveals a highly integrated system that makes dismantling and recycling an expensive, complicated, energy- and resource-intensive process. The composition of a panel includes aluminum, glass, complex plastics and an assortment of metals, including cadmium, chromium, lead, selenium and silver, among others, that left untreated and unmanaged, can contaminate soils and leach into groundwater systems. Because of the presence of heavy metals and other constituents that exceed regulatory thresholds for toxicity, end-of-life panels can be classified as a federally regulated hazardous waste under the Resource Conservation and Recovery Act, the statute governing the management of hazardous waste. This classification brings solar panels under the full spectrum of the U.S. Environmental Protection Agency’s hazardous waste regulations and carries a host of stringent regulatory obligations that make it expensive and burdensome to classify, store, handle and transport panels for recycling or disposal under existing law.

The end-of-life cycle issue reflects the lack of economically viable and sustainable end-of-life options, the predominant methods being landfill, incineration or “donation” (volunteer recycling) to secondary markets that shift the waste management burden to developing economies.

The Complexity of the Solar Recycling Process

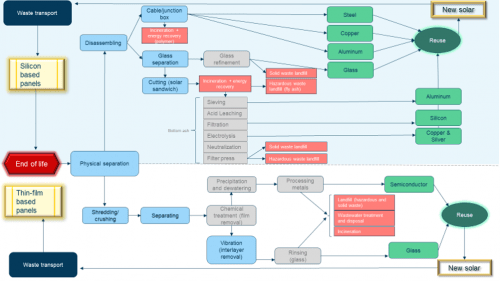

Recycling solar PVs is highly complex and can be an energy- and resource-intensive process that generates its own waste and emissions (Figure 1). Recycling technologies, particularly in the U.S., are still nascent and cost-prohibitive, which limits the final disposition options to landfill, incineration and export — the least expensive pathways by a wide margin. Due to the “hazardous waste” designation, current regulations require that waste solar panels be managed by qualified transporters and in permitted treatment, storage, disposal and recycling facilities. With the projected volumes of solar waste, it is uncertain whether existing hazardous waste and recycling facilities are adequate to manage the influx of panels given the protracted permitting timelines to site, construct and scale recycling facilities in the U.S.

These intricate regulatory obstacles, along with the direct cost of recycling, encourages abandonment, illegal dumping and stockpiling of waste solar panels while more affordable options emerge. Although precise figures are difficult to obtain due to misclassification of panels as electronic waste (e-waste) or other materials, lack of tracking mechanisms and data transparency, estimates are that ~10% of solar panels are recycled in the U.S., and it is unclear if this figure translates to full or partial recycling outcomes.

Although the solar recycling industry faces challenges of insufficient inputs, high operating costs and low profitability due to small concentrations of valuable materials, there is potential for a strong solar recycling market if infrastructure and supply chain collaborations existed to collect, process and sell the various components. However, none of those arrangements are currently in place. New circular business models should be developed and secondary markets established based on recycled, reused and recovered silicon, metals and materials for second-life panels and other applications that formalize reuse, repair and remanufacturing value chains in the solar PV industry.

Figure 1.

Source: Compiled from various sources by Rachel Meidl and Mathilde Saada.

Future Regulatory Models in the US

A national framework for end-of-life solar waste in the U.S. does not exist, but following California’s lead, EPA is currently weighing whether end-of-life panels should be regulated as “universal waste,” a category of hazardous waste with streamlined regulations intended to reduce management burdens and facilitate collection and recycling. California is the first state to regulate end-of-life solar panels as universal waste and their recent law could serve as a model for the future development of a national solar waste recycling framework and a blueprint for other states to follow. Hawaii, North Carolina and Rhode Island are also considering rules for governing solar panels in order to stimulate recycling. This framework is not only paramount for OECD countries, but critical for developing economies that are experiencing an unprecedented growth in solar (e.g., China and India), as formal waste disposal networks, recycling infrastructure and regulations are lacking in these regions of the world. As the solar recycling industry emerges and numerous players enter the market, one of the biggest challenges will be assigning responsibility for the vast amount of accumulated orphan waste.

Systems-Level Management for a Circular Economy

Recycling — or the proper disposal of hazardous materials if recycling is not possible — is indeed an essential component of a circular economy. However, first and foremost, we need enabling regulations that incentivize collection and proper end-of-life management of solar waste. This can help build solar recycling capacity while industry and secondary markets scale as part of a comprehensive end-of-life infrastructure. Investment incentives should also be considered in the suite of solutions to encourage the development of the solar recycling industry.

In the rush to decarbonize and electrify our society, waste management is oftentimes overlooked. Opportunities exist for developing properly scoped methodologies that account for the life cycle impacts across entire supply chains of commonly ignored factors of solar installations such as land use, biodiversity loss, environmental justice, water management and global transportation. Additionally, technologies such as blockchain can provide great impetus for transparent, accountable management of end-of-life panels. It is vital that we plan, prepare and design energy systems for reuse, recovery, remanufacturing and recycling in the present, or we risk creating new environmental, social and economic burdens in the future.

This post originally appeared in the Forbes blog on January 18, 2022.