By Kenneth B. Medlock III, Ph.D.

James A. Baker, III, and Susan G. Baker Fellow in Energy and Resource Economics; Senior Director, Center for Energy Studies

As cyber-sleuths work to unwind the nefarious hack on the Colonial Pipeline, one of America’s most critical pieces of energy infrastructure, the country is getting yet another lesson in the crucial role of energy storage. It is also getting a lesson in the importance of cybersecurity for maintaining our nation’s long-term energy security.

In April 2020, a lack of places to store oil triggered the short-lived negative WTI price in the depths of the COVID-19 lockdown, contributing to unprecedented market volatility and highlighting the importance of storage capacity for market stability. Just over a year later, the Colonial Pipeline outage is teaching us, yet again, the importance of storage.

The Importance of the Colonial Pipeline

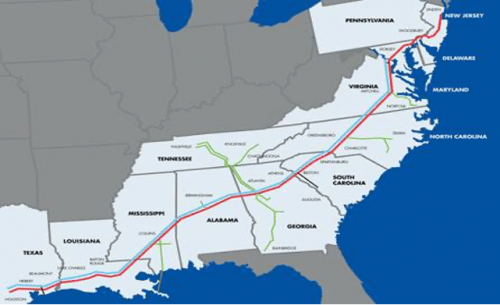

The Colonial Pipeline system has capacity to move 2.7 million barrels a day of refined petroleum products from refineries in the Gulf Coast (PADD 3) to the East Coast (PADD 1). The system provides states along the eastern seaboard about half of their total requirements for fuels such as gasoline, jet fuel, and heating oil. For perspective on just how large this is, the East Coast accounts for about one-third of America’s total petroleum product consumption.

Figure 1. Colonial Pipeline Map

Source: System Map (colpipe.com)

Given the arterial importance of the Colonial Pipeline for the East Coast, the pipeline going down has the potential to be a major blow to East Coast markets. This derives from the fact that the supply disruption is occurring as demand is rising with regional economic recovery from the COVID crisis, and as we approach one of the busiest driving weekends of the year—Memorial Day. The depth of pain this causes for East Coast consumers will depend on how rapidly the pipeline can return to normal operations, with each day that passes raising the prospects for fuel shortages.

Outage Impacts

The Colonial Pipeline outage will drive market adjustments, and storage will be a centerpiece of how impacts of the outage materialize. On the East Coast, local demands will be met by the drawdown of petroleum product inventories from storage. In turn, this will act to buffer upward pressure on price from the pipeline supply disruption. On the Gulf Coast, the outage has left refined products effectively stranded, searching for a home in an oversupplied PADD 3 market. In response, storage capacity will fill, acting to buffer the impact by offering a short-term place of residence until the pipeline can re-open. In other words, the existence of storage at either end of the pipeline is an unsung hero in this crisis. Without it, the Colonial Pipeline shutdown would have wreaked havoc instantly—at both ends of the system.

Nevertheless, it is imperative that the pipeline re-opens quickly. The longer it stays closed and as storage imbalances grow on both ends of the system, repercussions could be dramatic.

On the East Coast, an extended shut down will deplete storage. Given the relative lack of local refining capacity, prices on the East Coast will increase due to undersupply. Imports of refined products into East Coast ports could help, but the Jones Actprecludes this supply from being fully sourced domestically; so, it would need to be imported from overseas.

On the Gulf Coast, if storage fills up refiners may need to reduce their crude oil runs if they have nowhere to put refined product. This oversupply will push down prices. Of course, the international market can also provide a relief valve for excess Gulf Coast supplies, but the extent to which this happens will depend on price and logistical considerations. The Gulf Coast region already exports about 7.2 million barrels per day of crude oil and petroleum products annually to international buyers.

If the pipeline outage lingers, the price spread between the East Coast and Gulf Coast will widen, unleashing all sorts of market responses that are difficult to predict but will be aimed at capturing the arbitrage value that emerges. Even if such a scenario doesn’t take place, we will almost certainly hear regional stories about gasoline prices spiking. In some regions, local fuel shortages will drive price increases, particularly where constraints arise due to a lack of storage or limited access to alternative supplies. In other regions, particularly those with denser fuel delivery infrastructure, the ability to access alternate fuel supplies will limit price increases, at least for a while. But, the longer the pipeline is down, the more we will see local inventories depleted, and stories of fuel shortages and spiking prices will become more common.

The Lessons for US Energy

To prevent the worst possible outcomes, the Biden Administration can move quickly to abate the growing supply mismatch. Temporary fixes include relaxing regulations on trucking for fuel supplies across state lines and issuing Jones Act waivers to ship cargoes from the Gulf Coast to the East Coast. Indeed, Jones Act waivers have helped with similar disruptions in the past. Regardless, any steps that can be taken serve to relax market constraints so that trade can happen more freely. This, by itself, is an important lesson in market resilience.

More generally, the entire event is a lesson in the important role of storage for short-term market security and stability, and the lesson applies to markets for every energy commodity. Perhaps even more importantly, the nature of the pipeline outage underscores the importance of cybersecurity for maintaining our nation’s long-term energy security. Both points need to be fully onboarded as the US energy system transitions and becomes increasingly digital.

Cybersecurity concerns have been discussed for years. All too often, however, we find ourselves living through an event before its costs are internalized, leaving policy to be reactive. Irrespective of how quickly the shutdown of the Colonial Pipeline is resolved, this event should trigger a concerted review of cybersecurity policy in the US as it relates to energy infrastructure, with an aim to identifying and resolving, or at least establishing contingencies for, potential cyber risks.

For now, the focus should be on getting the Colonial Pipeline fully operational, and taking steps to ensure any fuel supply shortages that may emerge in the interim are mitigated. But, make no mistake, this outage is a warning shot. It is revealing of what could transpire if coordinated cyberattacks were to occur across multiple energy systems simultaneously, and it highlights the important role that robust energy storage can play in mitigating damages.

This post originally appeared in the Forbes blog on May 11, 2021.